irs income tax rates 2022

The top marginal income tax rate. Ad Time To Finish Up Your Taxes For Free With TurboTax Free Edition.

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

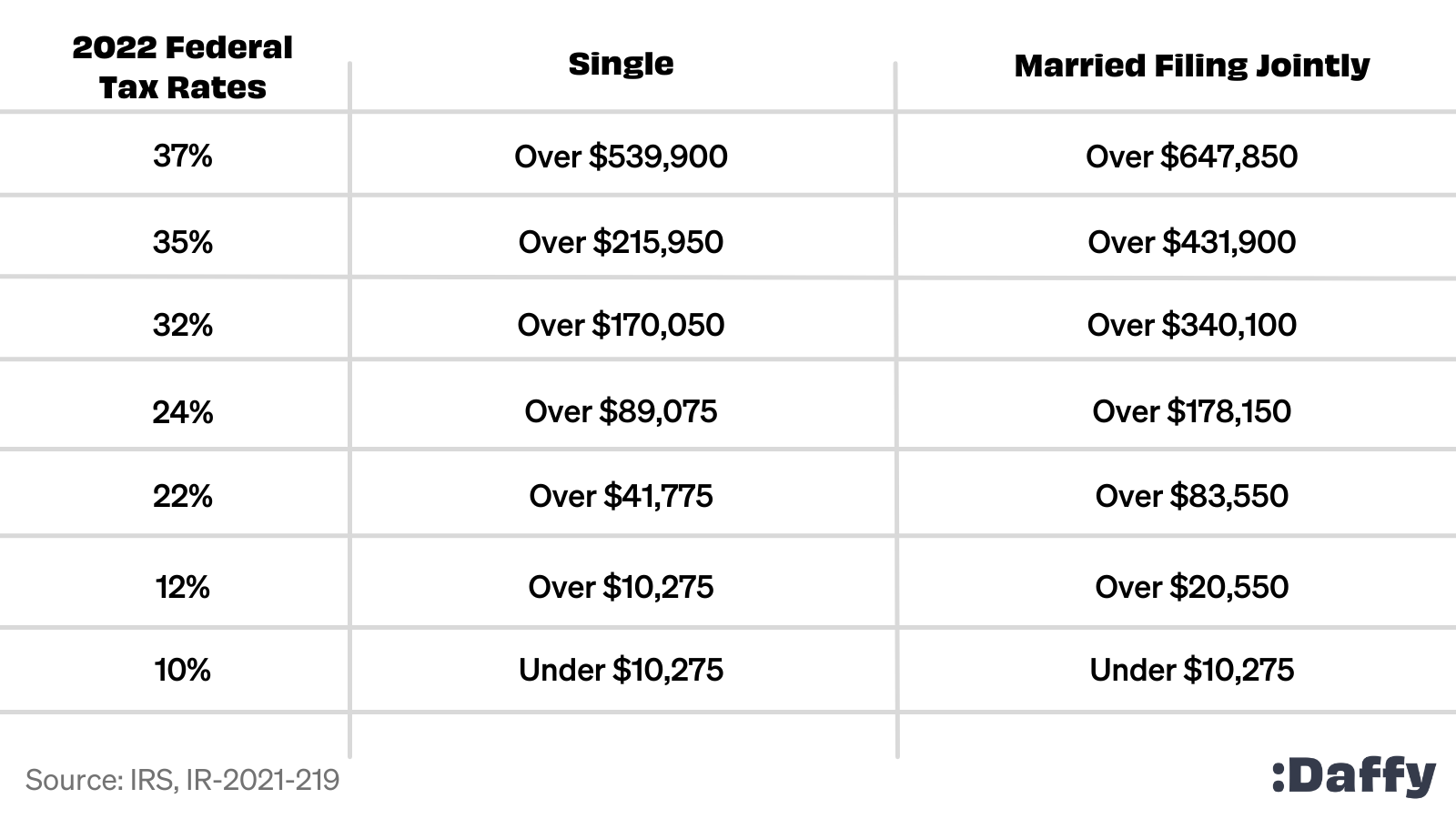

Your bracket depends on your taxable income and filing status.

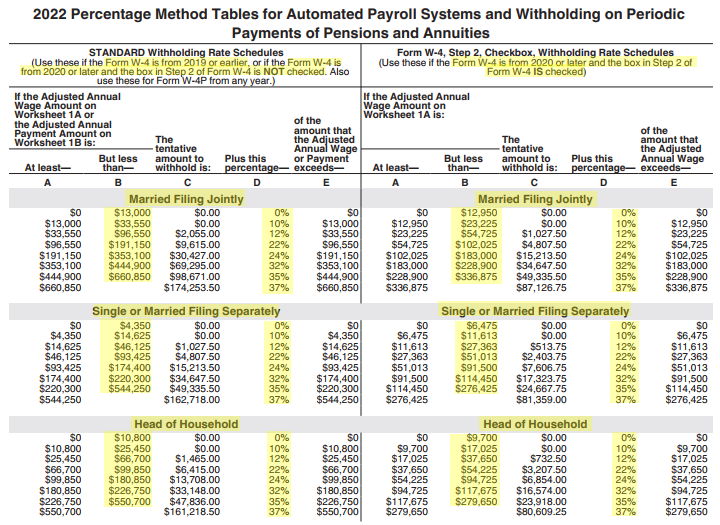

. The United States Internal Revenue Service uses a tax bracket system. Each month the IRS provides various prescribed rates for federal income tax purposes. The top tax rate for individuals is 37 percent for taxable income above 539900 for tax year 2022.

Your 2021 Federal Income Tax Comparison. Time To Finish Up Your Taxes. See If You Qualify.

Your 2021 Tax Bracket To See Whats Been Adjusted. Due Date for 2021 Returns. 12 tax rate for income over 10275 but less than 41775.

What is his regular federal income tax. Ad Compare Your 2022 Tax Bracket vs. The tax rate increases as the level of taxable income increases.

The due date to file your 2021 income tax return or extension form is April 18 2022The due date is April 18 instead of April 15 because of the Emancipation Day. Whether you are single a head of household married. That means that your net pay will be 43324 per year or 3610 per month.

Tax brackets for income earned in 2022 37 for incomes over. The 2022 tax brackets for single tax filers. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

There are -911 days left until Tax Day on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

The dates on the transcript indicate the date those credits. These are the taxes owed for the 2021 - 2022 filing season. 2 2What Does IRS Code 766 Mean On IRS 2022 and 2021 Tax 3 3What does code 766 mean on IRS.

There are seven federal income tax rates in 2022. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. As per the Federal Budget 2022-2023 presented by the Government of Pakistan the following slabs and income tax rates will be applicable for.

43500 X 22 9570 - 4383 5187. Your marginal federal income tax rate. These are the rates for.

These rates known as Applicable Federal Rates AFRs are regularly published as. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. There are seven federal tax brackets for the 2021 tax year.

If you make 55000 a year living in the region of California USA you will be taxed 11676. Import Your Tax Forms And File With Confidence. 35 for incomes over 215950 431900 for.

10 12 22 24 32 35 and 37. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. This calculator is for 2022 Tax Returns due in 2023.

Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187. The 2022 tax rate ranges from 10 to. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS.

Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to. E-File Your Tax Return Online. Discover Helpful Information And Resources On Taxes From AARP.

Your average tax rate is. Salary Income Tax Slabs 2022 - 2023. 2022 Standard Deductions Mark Kantrowitz The Alternative Minimum Tax AMT exemption is 75900 for single filers 118100 for married filing jointly 59050 for married.

Your effective federal income tax rate. Individual income tax revenue.

Baseline Estimates Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

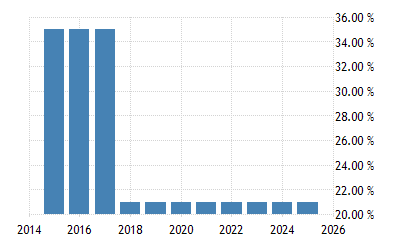

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

The Truth About Tax Brackets Legacy Financial Strategies Llc

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

The Complete 2022 Charitable Tax Deductions Guide

State Income Tax Rates And Brackets 2022 Tax Foundation

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

2022 Income Tax Brackets And The New Ideal Income

Powerchurch Software Church Management Software For Today S Growing Churches

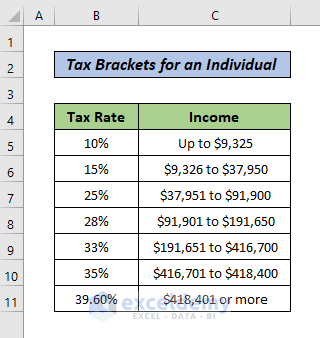

How To Calculate Federal Tax Rate In Excel With Easy Steps

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Income Tax In The United States Wikipedia

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

2021 2022 Federal Income Tax Brackets And Rates Wsj

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities